Condo Insurance in and around Woodland Hills

Welcome, condo unitowners of Woodland Hills

Protect your condo the smart way

Home Is Where Your Condo Is

When it's time to kick back, the safe place that comes to mind for you and your favorite peopleis your condo.

Welcome, condo unitowners of Woodland Hills

Protect your condo the smart way

Agent Gwyn Petrick, At Your Service

That’s why you need State Farm Condo Unitowners Insurance. Agent Gwyn Petrick can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Gwyn Petrick, with a straightforward experience to get dependable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Gwyn Petrick can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let worries about your condo make you unsettled! Reach out to State Farm Agent Gwyn Petrick today and find out how you can save with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

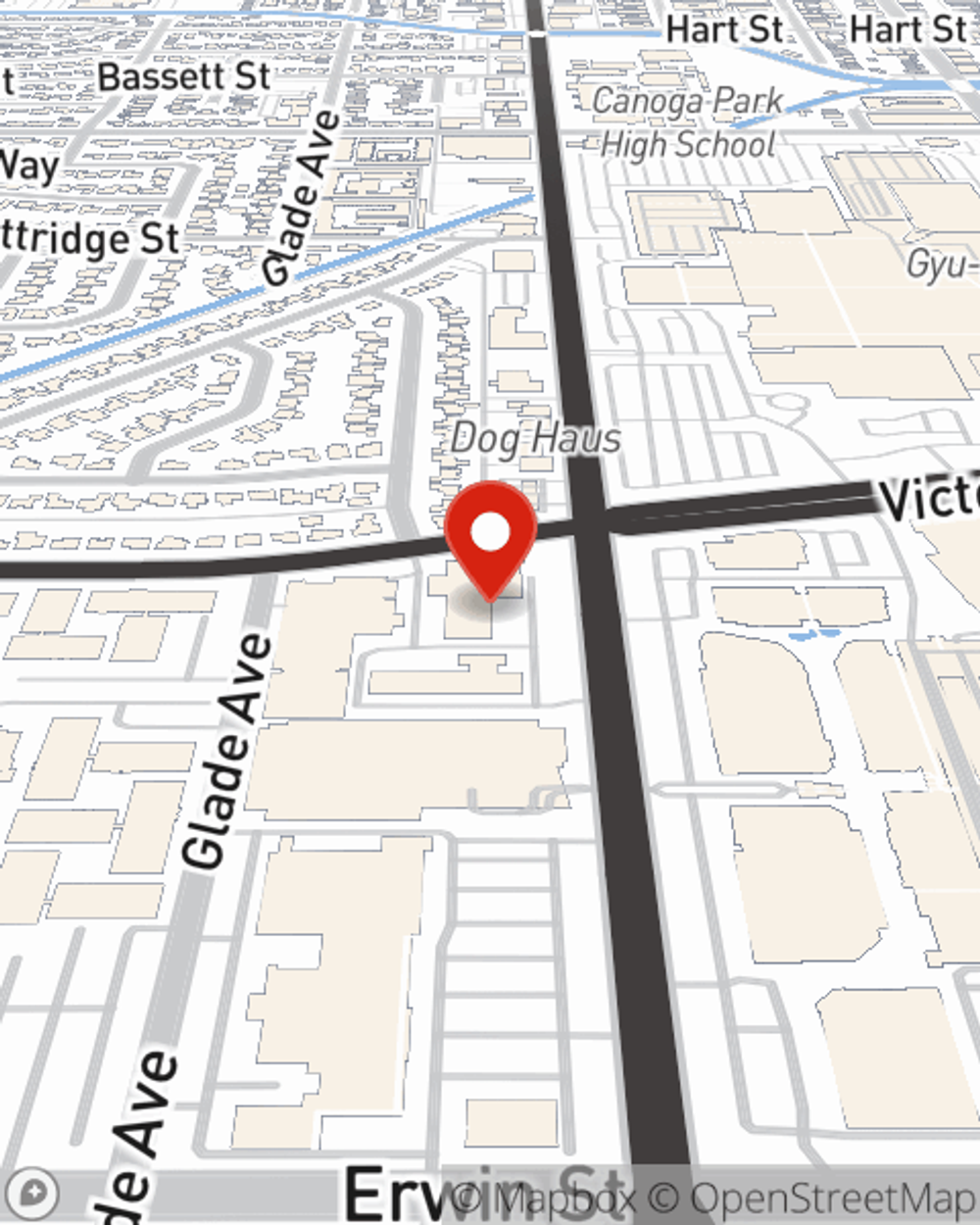

Call Gwyn at (818) 592-0055 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Gwyn Petrick

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.